are political contributions tax deductible in california

To qualify for the tax exemption a charity must be organized and operated exclusively for religious charitable scientific and testing for public safety literary or. Money that you contribute to a person campaign or political party is not tax deductible.

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Political Donations Are NOT Tax Deductible.

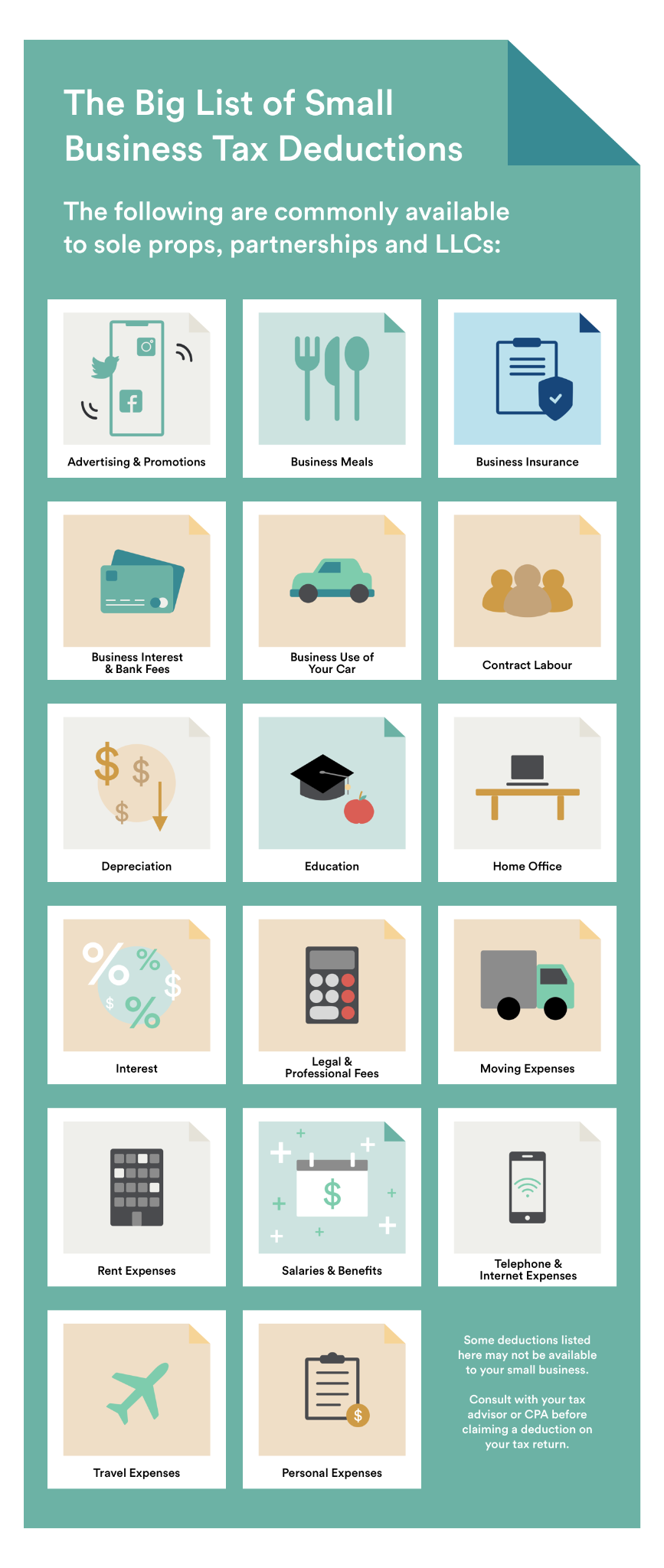

. The short answer is no they are not. There are five types of deductions for. Most political contributions whether local regional or national are not tax deductible and havent been for years.

Individuals may donate up to 2900. So the answer is no. The state is very open about where you can donate.

Federal law limits your state and local tax SALT deduction to 10000 if single or married filing jointly and 5000 if married filing separately. Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns. California does not allow a deduction of state.

Money that you may. Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns. To be precise the answer to this question is simply no.

No political contributions are not tax-deductible for businesses either. You need to itemize each charitable donation made individually or by a business. If you make less than 200000 jointly or 100000 individually you can claim a tax credit of 100 and 50 respectively.

Please note that beginning January 1 2021 a state campaign contribution limit will by default apply to city and county candidates when the city or county has not already enacted laws. Many donors ask our service team the same question. You are to itemize your taxes on form.

The IRS is very clear that money contributed to a politician or political party cant be deducted from your taxes. Are political contributions tax deductible. The longer answer is.

These taxes should be documented and kept for future reference. Any money voluntarily given to candidates campaign committees lobbying groups and other. The rules are the same for donations of both money and time.

These business contributions to the political organizations are not tax-deductible just like the individual. A tax deduction allows a person to reduce their income as a result of certain expenses. Any time you donate to a political candidate political campaign or political action committee.

Political contributions arent tax deductible. It depends on what type of. To be precise the answer to this question is simply no.

Individuals can elect to deduct. It can seem like news and advertisements about political. If youre self-employed however you can deduct the cost of any supplies or services you donate to a.

In a nutshell the quick answer to the question Are political contributions deductible is no.

Are My Donations Tax Deductible Actblue Support

States With Tax Credits For Political Campaign Contributions Money

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible Smartasset

Are Political Contributions Tax Deductible H R Block

Pin By Jimmie Dean Briley On Christmas Doubledown Casino Vegas Slots Democratic Republic Of The Congo

Are Political Contributions Tax Deductible H R Block

The Business Travel Tax Deduction What It Is And How To Take Advantage Of It Traveldailynews International

What Are Non Deductible Expenses Rydoo

Are Political Contributions Tax Deductible Smartasset

Are Political Donations Tax Deductible Credit Karma

The 4 Tax Strategies For High Income Earners You Should Bookmark

Tax Deductible Rats Deliver Nothing To The Lowest Paid How Very Morrison Government Richard Denniss The Guardian

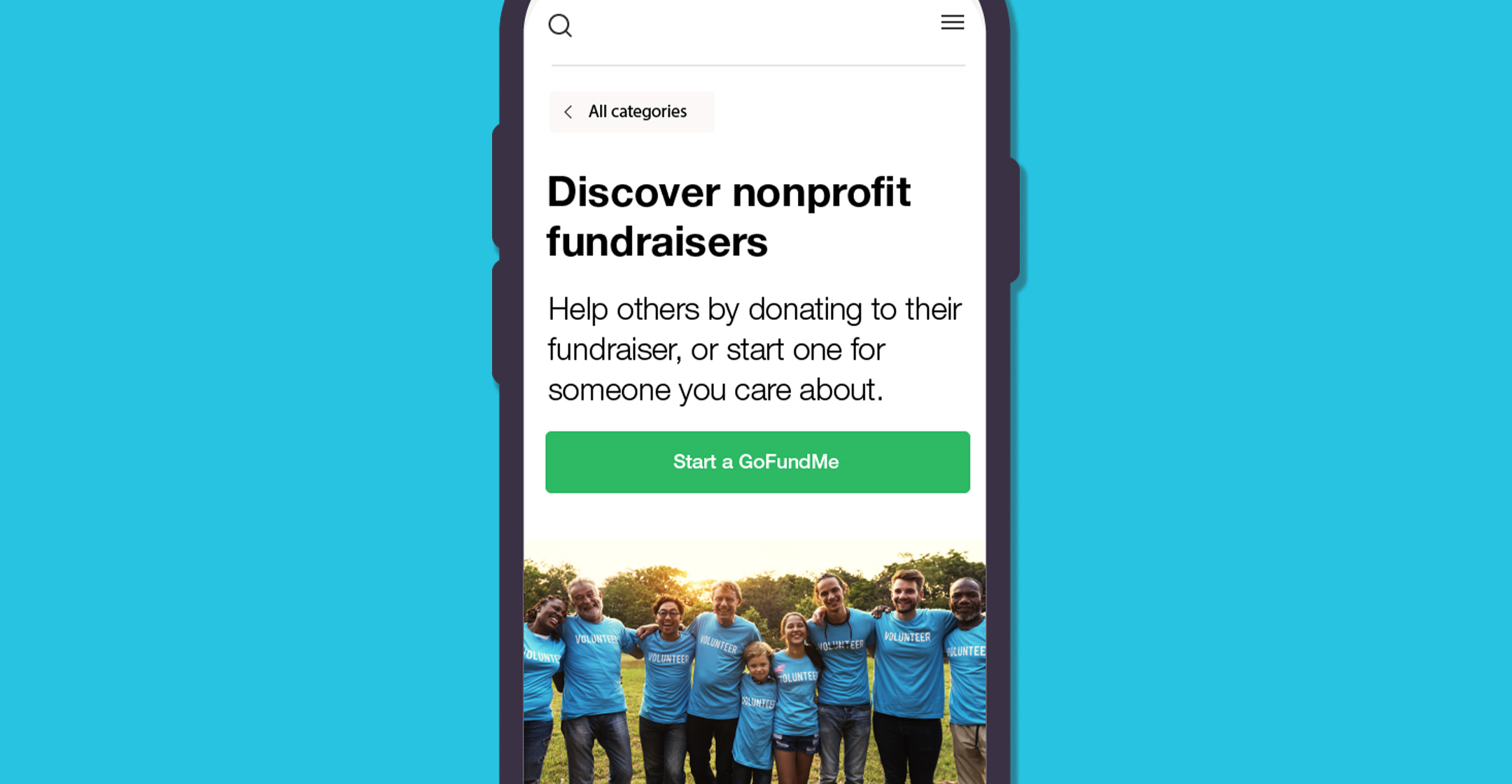

Are Gofundme Donations Tax Deductible We Explain

Are Political Contributions Tax Deductible Smartasset

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)